April 11th 2019

Dublin coworking identified as a “hotspot” of growth in Europe.

This impressive statement comes from recent findings by Cushman & Wakefield. Other key hotspot areas they identified were Helsinki, Stockholm and Amsterdam.

Cushman & Wakefield currently track over 11 million square feet of Serviced Offices, including coworking spaces, so they are in a position to provide invaluable information and insight into the growing market.

Dublin coworking: How does it compare?

London has the biggest market share of coworking space in Europe, with 1.1 million square feet of office space. However, this recent report isn’t just looking at the quantity of stock, rather it is assessing the potential for future growth.

See our London Serviced Offices

Dublin, along with the three other cities, has displayed that the conditions are right for extensive growth in the Serviced Office market.

See our Dublin Serviced Offices

European coworking

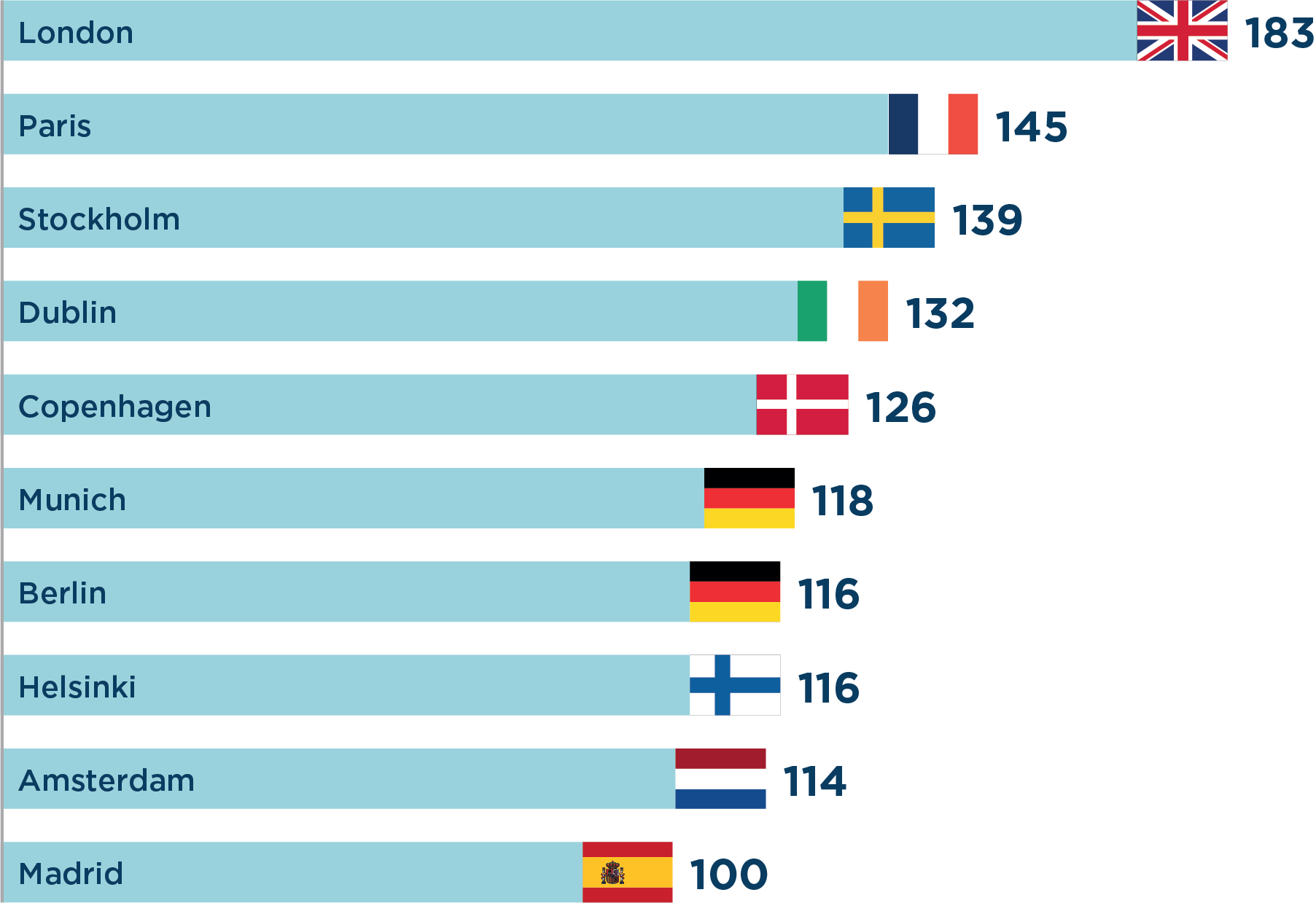

Cushman & Wakefield‘s report compiled a list of European coworking Hotspot Index of 10 key markets. More than 40 cities were initially analysed and scored using quantifiable real estate and economic measures. While London and Paris fared extremely well on the list, the identified hotspots of growth show the huge potential of coworking in the future.

Source: Cushman & Wakefield Research

Comment

Report author Elisabeth Troni, Cushman & Wakefield’s, says:

“Our European coworking Hotspot Index adds a twist to the traditional office market hierarchy and shows the disruptive potential of this fast-emerging sector. However, coworking growth potential also reveals a wide range of dynamic factors underlying a city’s office market. In particular, the growth in co-working represents a clear shift in employment towards digital and technology-based sectors and away from traditional financial services.

“The new growth sectors of the digital economy are more nimble – and comfortable with flexible working practices. This change in tenant preferences for flexible working is shifting the balance of power towards the tenant as the landlord looks to adjust and adapt their strategies in response. With a better understanding of city-level demand drivers for co-working, operators and landlords can be more informed as to which type of workplace offer is most likely to succeed in cities across Europe.

“Our analysis shows every city is different. We expect demand for co-working to be strong in our featured hotspot markets and would recommend that coworking operators and office landlords and investors alike adopt a proactive strategy to managing their response to these dynamics.”